Joint Ventures in Dubai Real Estate: The Complete Guide

The Dubai real estate market has become one of the most attractive destinations for international investors in recent years. Beyond opportunities for buying existing properties, there are now more flexible forms of participation, such as joint ventures (JVs). This tool allows different parties to pool resources, expertise, and strategic interests to execute large-scale projects with lower risks and greater prospects for profit.

Unlike simply buying an apartment or a whole floor, the joint venture Dubai model allows investors to participate in a development on a level previously only accessible to large companies. This approach is now actively used by both local players and international investors looking to diversify their portfolios and take part in one of the world's most dynamic markets.

This article is a complete guide to understanding what is a joint venture in the Dubai real estate market, how it works, its advantages and disadvantages, and when this format is most effective.

What Is a Real Estate Joint Venture?

A joint venture meaning is a form of partnership in which two or more investors combine resources to carry out a single real estate project. In Dubai, these agreements are particularly popular because the market is constantly growing, and projects require significant financial and management investment. JVs allow for the sharing of both costs and future profits while maintaining transparency and a balance of interests between the parties.

There are different types of joint ventures. The most common are equity JVs, where partners invest capital into a joint project in agreed-upon proportions, and operational JVs, where one party acts as the developer or management company, and the other provides financing. In some cases, a hybrid model is used, where investors contribute not only money but also land, technology, or management expertise.

The key difference between a joint venture vs partnership and traditional investment methods like buying an apartment or a single floor is the level of participation. Instead of passive ownership of a finished asset, an investor gains access to the project's creation and management process, influencing strategic decisions. This opens the door to higher profitability and expands opportunities for portfolio diversification.

The Evolution of Dubai Real Estate Investments

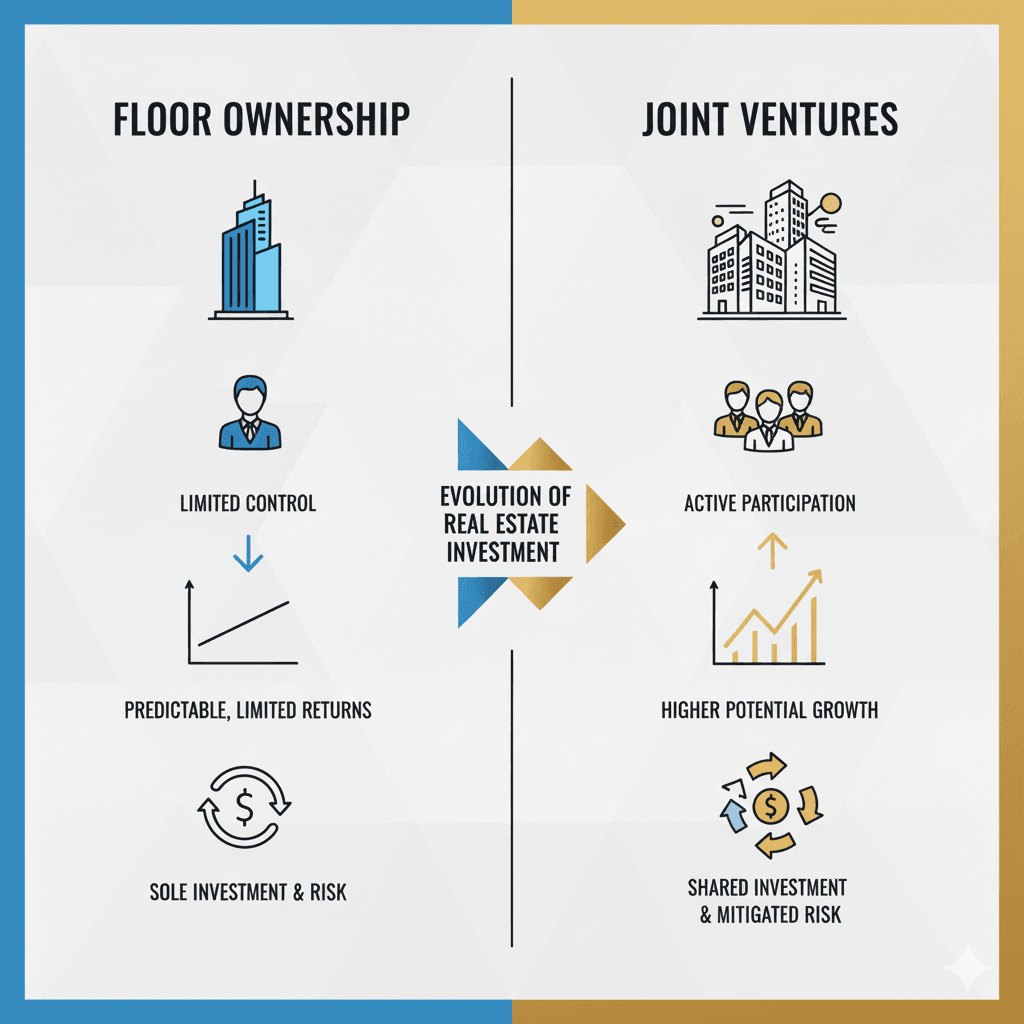

Over the last 5–7 years, the Dubai real estate market has undergone significant changes. While previously the main form of participation for foreign investors was the direct purchase of individual apartments or units, a trend towards larger deals has gradually emerged. One of the first steps in this direction was "floor buying"—acquiring entire floors in residential and commercial projects. This approach allowed investors to get a bulk discount and more quickly diversify their capital within a single property.

Over time, it became clear that floor buying had its limitations. First, the investor was dependent on the developer's strategy and had no real influence on the development process. Second, the profitability of this tool was predictable but limited: resale or rental remained the only sources of profit. For more experienced players, this was not enough.

Amid Dubai's active development and developers' ambitious plans, new opportunities arose. Investors began shifting to partnership models, such as joint real estate investments. The joint venture advantage is that it allows participation in projects from the very beginning—from selecting the land plot to the future management of the property.

These changes were especially pronounced after the global market stabilized and interest in Dubai as an international financial and tourist hub grew. The government also contributed by introducing transparent regulations, which increased trust among foreign partners.

Today, the Dubai real estate market is no longer just an opportunity to buy an apartment or a villa by the sea. It's a platform for large-scale investment strategies, where joint ventures open up access to world-class projects, providing investors with completely new horizons of profitability and control.

Why Investors Are Shifting from Floor Buying to Joint Ventures

The floor-buying format remained popular for a long time as it allowed for profit from renting or reselling an entire floor. But as the market matured and more sophisticated investment tools emerged, investors began looking for models that offered more control, transparency, and profit potential. This is why joint venture opportunities in Dubai became the logical next step.

The main reason for the shift to joint ventures is access to major projects—the opportunity for an investor to enter projects that are inaccessible to an individual investor when buying a floor.

The move from floor investing to joint ventures is not just a trend but a strategic choice for investors seeking to increase flexibility and returns on their investments. This model is especially appealing to those who see Dubai not as a single-transaction market but as a long-term platform for capital growth.

Floor Buying vs Совместные предприятия

| Floor Buying | Совместное предприятие |

|---|---|---|

Level of Control | Minimal | High, with participation in management |

Investment Size | Medium | Flexible, depending on the agreement |

Profit Potential | Limited (rent/resale) | Higher, with participation in development |

Risks | Solely on the investor | Shared among partners |

Project Scale

| Small or medium | Large, complex projects |

Access to Expertise

| Limited | Collaboration with developers |

How Joint Ventures in Dubai Work

Real estate joint ventures in Dubai are built on clearly structured agreements where each party understands its role and level of responsibility. Typically, these projects involve two key partners: the developer, who has expertise and access to land resources, and the investor, who provides financing or additional assets. However, the composition can be broader, including management companies, marketing consultants, and legal partners.

In practice, a JV structure looks like this: the parties define each participant's contribution, which can be capital, a land plot, professional knowledge, or management resources. Then, the terms of profit distribution are set: as a rule, the share of participation directly reflects the size of the contribution. This ensures a fair balance of interests.

Profit from the project is distributed according to the participation shares and pre-agreed terms. Most often, investors receive income in two forms: a share of the profit from the sale of properties and dividends at the end of the JV's operation. This approach makes the model flexible and transparent and reduces risks, as all parties are interested in successful execution.

Key Advantages for Investors

The format of joint project participation has already established itself as one of the most effective tools in the Dubai real estate market. When talking about the advantages and disadvantages of a joint venture, the main advantage for an investor is the opportunity to work on large projects while sharing risks with partners. This approach opens up a wider range of strategies than the classic purchase of finished real estate.

The key joint venture advantage for investors include:

Access to large-scale projects: The ability to participate in the development of large-scale properties that are not available to individual investors.

Risk reduction: The financial burden is distributed among partners, making the investment safer.

Collaboration with leading developers: Working side-by-side with market professionals improves the quality of execution.

Portfolio expansion: JVs allow for asset diversification and balancing profitability.

Transparency and balance of interests: Clear contractual mechanisms regulate the rights and obligations of the parties.

By choosing this format, an investor gets not only access to capital and professional expertise but also the opportunity to shape their own vision for the project along with their partners. JVs are a "point of entry" into Dubai's real estate ecosystem, where not only the investment but also the participation in creating new urban spaces is valued. For many, this is a chance to turn an investment into part of a long-term strategy rather than limiting themselves to one-off transactions.

Learn more about joint ventures in Dubai

Potential Risks and How to Avoid Them

Despite the obvious benefits, investing through joint ventures in Dubai involves certain risks. The main ones are related to the selection of partners, legal nuances, and market dynamics. Ignoring these factors can lead to reduced profitability or project delays.

One of the key risks is choosing the wrong partner. Even if a project looks promising, a partner's poor financial discipline or lack of experience can jeopardize the overall result. Therefore, it's crucial to conduct a detailed analysis in advance, checking their reputation and portfolio of completed projects.

Another risk is related to legal aspects. Insufficiently clear terms in a joint venture agreement can lead to conflicts over profit distribution or project management. To avoid this, it's necessary to engage professional lawyers who will ensure transparency and legal protection of the parties' interests.

It's also important to consider market risks: changes in demand, real estate price fluctuations, and regulatory changes. It's impossible to eliminate them completely, but diversifying investments and participating in projects with different payback horizons helps reduce the impact of external factors.

A common challenge is the uneven distribution of expectations among partners. To minimize this risk, it's useful to establish regular reporting, set key performance indicators, and align on a strategy at every stage.

Legal and Tax Aspects of Joint Ventures in Dubai

The successful operation of a joint venture Dubai real estate project largely depends on proper legal documentation. Several types of agreements define the JV structure: a Shareholders Agreement, a Joint Venture Agreement, or a contract based on a Special Purpose Vehicle (SPV). Each format regulates the rights and obligations of the parties, the procedure for making contributions, and profit distribution.

Special attention is paid to protecting the investor's rights. The laws of the UAE, and especially the free economic zones, provide for a high degree of transaction transparency. Agreements specify mechanisms for exiting the project, dispute resolution procedures, and voting rules on key issues. This reduces the risk of conflicts and ensures a balance of interests.

Tax conditions in Dubai also favor the development of joint ventures. The absence of personal income tax and minimal corporate taxation make the model attractive to international investors. However, it's important to note that a 9% corporate tax was introduced in 2023 for businesses exceeding a certain profit threshold. It's crucial to structure the enterprise correctly and consider international agreements to avoid double taxation.

The legal and tax aspects in Dubai create a favorable environment for joint venture opportunities in Dubai, provided that all agreements are legally sound. Competent support from professional consultants allows investors to feel secure and focus on developing the project itself.

Who Can Be Your Joint Venture Partner in Dubai?

Choosing a partner is one of the key factors for the success of a real estate joint venture. In Dubai, the most common JV partners are developers with expertise in design and construction, as well as landowners willing to contribute their land as their share. Financial investors, including private funds and international companies looking for access to large projects without needing to manage operations, are also in high demand.

Sometimes, partners are management companies or specialized professionals who bring their expertise to the project. This format is often chosen when an investor needs a strong local player to effectively conduct business in the region.

When choosing a partner, it's important to consider the following criteria:

Experience and reputation: A track record of successfully completed projects and a positive history in the market.

Financial stability: The ability to fulfill obligations in full.

Alignment of strategic goals: A shared understanding of project timelines, scale, and exit strategy.

Transparency in communication: A willingness to provide regular reporting and be open at all stages.

A well-chosen partner minimizes risks and takes the project to a new level. This is why investors pay special attention to thoroughly vetting potential allies.

The JV Investment Process: A Step-by-Step Guide

Investing in a Dubai real estate joint venture requires a clear sequence of actions. A proper understanding of each stage helps avoid mistakes and increases investment efficiency. Investors can follow this step-by-step process to get from the initial idea to receiving a profit:

Define Goals and Budget: The investor must clearly state their objective—capital diversification, long-term rental income, or participation in construction. At this stage, it's important to determine the available funds and the acceptable level of risk.

Find a Suitable Project and Partner: This involves considering the developer's reputation, the future project's scale, and the partner's financial stability. Experts at Mayak Real Estate can assist in this selection phase, offering only vetted projects and reliable allies.

Legal Due Diligence and Analysis of Terms: This includes assessing the land plot, title documents, and the financial model. It's important to ensure that the terms of participation are transparent and the distribution of shares is fair.

Drafting and Signing the Agreement: The joint venture agreement is drawn up, detailing the parties' contributions, management procedures, project exit rules, and profit distribution mechanisms. Legal support is a mandatory condition.

Forming the Management Structure: A separate company or committee is created to manage the project. The parties allocate authority and approve an action plan.

Project Execution: This stage includes design, construction, marketing, and sales. The investor participates in making key decisions and overseeing the implementation.

Receiving Profit: Upon completion of construction, income is distributed according to the shares: through the sale of properties, rent, or dividend payments.

The JV investment process is transparent but requires professional support at every stage. Mayak Real Estate provides support from project selection to profit distribution, helping investors use their capital as effectively as possible.

Contact us to discuss participation in joint ventures

FAQ

What is a real estate joint venture?

It's a form of partnership where investors and developers combine capital, land, and expertise to execute a single project. Profits and risks are shared among the parties depending on the terms of the agreement.

How is a JV different from buying an apartment or a whole floor?

Unlike classic ownership of a finished property, a JV allows you to participate in creating a project from scratch and influence its development. This format unlocks greater profit potential and access to large-scale properties.

What are the main advantages of a JV?

The key benefits include participation in major projects, shared risks, working with experienced developers, transparent agreements, and portfolio diversification. This makes the model especially attractive for international investors.

What risks exist and how can they be minimized?

The main risks are related to choosing an unreliable partner, legal inaccuracies, or changes in the market situation. They can be minimized through careful partner vetting, professional legal support, and investment diversification.

How is profit distributed in a JV?

Profit is divided in proportion to the shares of participation, which are fixed in the agreement. Investors can earn income from property sales, rentals, or dividends.

Who can be a partner in a JV?

Most often, these are developers, landowners, financial investors, or management companies. The main criteria are reputation, experience, and an alignment of strategic goals. When choosing a partner, it's also important to assess their financial stability and transparency.

Where does the JV investment process begin?

Investing in a joint venture begins with setting goals and defining a budget. This is followed by project and partner selection, legal due diligence, agreement signing, and execution. Mayak Real Estate provides support to investors at all stages.

What are the tax conditions for JVs in Dubai?

Dubai has no personal income tax, and the 9% corporate tax only applies to large companies with high profits. This makes joint ventures a profitable tool for international investors.

What is Mayak Real Estate's role in the investment process?

The company assists clients at every stage—from selecting a project and partners to legal verification, agreement signing, and property management. This approach allows investors to feel protected and confident in the outcome.

Conclusion

In recent years, joint ventures in Dubai have become one of the most flexible and effective ways to invest. They allow for combining the resources of different parties, sharing risks, and participating in projects that would be nearly impossible to undertake alone. This format is especially in demand among investors who seek a balance between profitability and security, and who value transparency and a structured approach.

Real estate joint ventures are best suited for those who are ready for long-term projects, want to expand their portfolio, and are looking to work with the region's leading developers. It's the optimal choice for investors interested not only in financial profit but also in strategic partnerships where access to allies' experience and contacts is valued.

At the same time, if an investor prefers complete independent control, is unwilling to share management, and expects quick liquidity, then the classic purchase of a finished property or an entire floor may be a more suitable model. The choice between a joint venture vs partnership and traditional investments depends on your goals, planning horizon, and readiness for collaboration.