Leasehold Property in Dubai

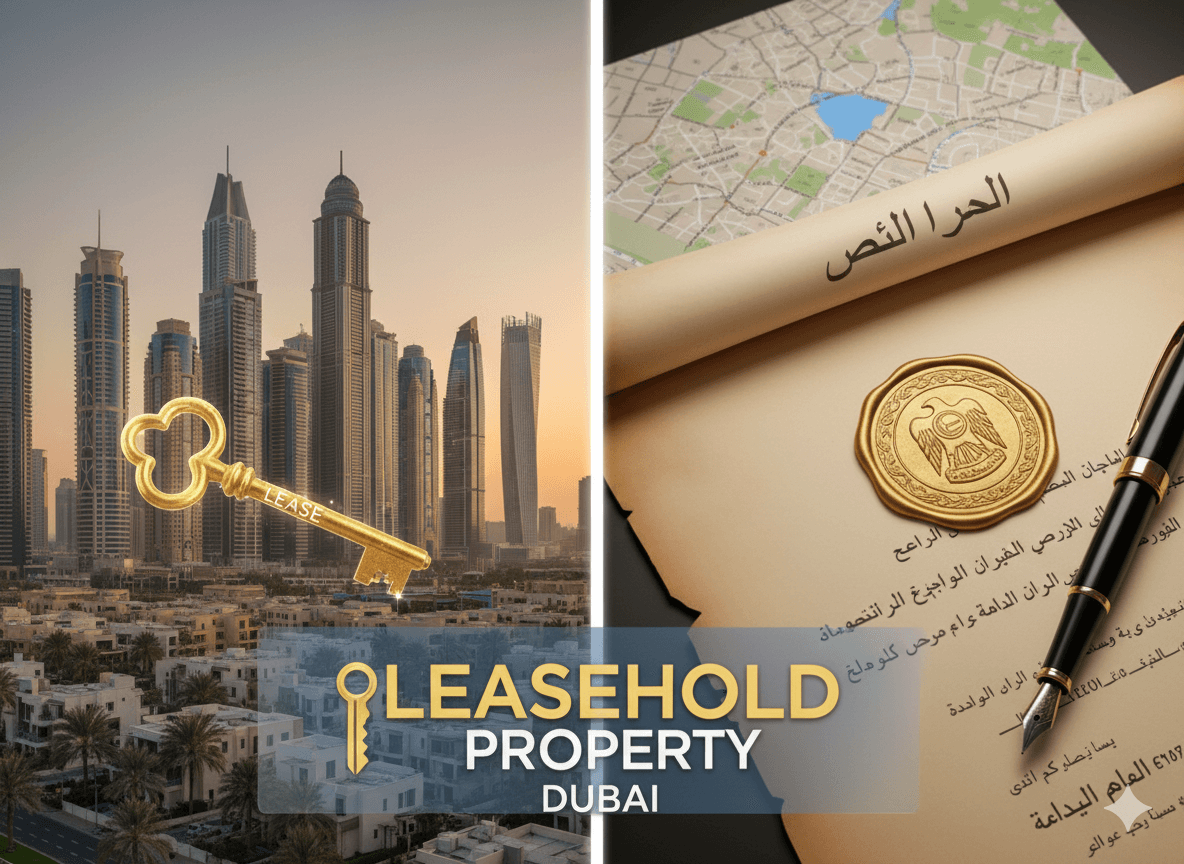

Leasehold is a form of property ownership where the buyer obtains the right to use the property for a specified period. After this term ends, ownership rights revert to the landowner—typically the developer or the government. This format is especially popular among foreign investors and buyers looking for an affordable entry to Dubai's real estate market without the need to purchase a freehold property.

Leasehold allows ownership of modern apartments in prestigious Dubai areas at lower prices than comparable properties in freehold zones. This makes it an attractive option for those who want to live in Dubai, rent out the property, or test the market before buying full ownership real estate.

What Is Leasehold Property in Dubai?

A leasehold property is one acquired not as full ownership but temporary possession under a lease agreement. These leases are typically for 30, 50, or 99 years. During this period, the buyer (lessee) has full rights to use the property: live in it, rent it out, make cosmetic repairs, or sell lease rights to third parties if allowed by the contract.

Under UAE law, the land where leasehold property stands remains owned by the landlord—usually the developer or government. The buyer must comply with lease terms, timely pay service charges, utilities, and annual fees, and maintain the property in good condition.

At lease expiry, ownership rights fully revert to the landowner unless the lease is renewed. Briefly, leasehold offers temporary but legitimate property use blending advantages of renting and real estate investment in Dubai's promising market.

Leasehold vs Freehold: Key Differences

Dubai's real estate market offers two main ownership types: leasehold and freehold. Understanding their differences helps investors and buyers choose the best model for their goals and budget.

Leasehold grants property rights for a limited term—usually up to 99 years—after which rights return to the landowner. Freehold offers permanent ownership of the property and land without time restrictions.

Leasehold appeals to foreign investors seeking access with lower upfront costs. It's also suited for short-term investment strategies such as rental income over several years. Freehold targets long-term investment, residents, and those wishing to pass property as inheritance.

Key Differences Table: Leasehold vs Freehold

Criterion | Leasehold | Freehold |

|---|---|---|

Ownership Type | Temporary (30–99 years) | Full ownership without limitation |

Land Rights | Land remains with landlord | Land owned by property owner |

Right to Sell/Transfer | Only with landlord approval | No restrictions |

Purchase Price | Lower than freehold | Higher, especially in prime areas |

Lease Renewal | Possible by agreement | Not needed |

Investor Profile | Short-term/budget investors | Long-term owners and families |

Risks | Dependent on lease terms | Minimal with full ownership |

Maintenance Responsibility | Usually lessee, limited changes | Full owner responsibility |

Foreign Buyer Access | Limited to certain zones | Allowed in designated freehold zones |

Inheritance Transfer | Dependent on lease terms | Unlimited inheritance rights |

Choosing between leasehold or freehold depends on your investment aims: leasehold offers flexibility and affordability, freehold ensures stability and asset ownership.

Popular Leasehold Areas in Dubai

While most popular Dubai areas are freehold zones, some districts allow foreigners to purchase leasehold properties only. These areas tend to be more affordable and include diverse housing options—from apartments in bustling business hubs to family residences in quieter neighborhoods.

High-demand leasehold districts include:

Deira: Historic Dubai center with affordable apartments and commercial space, offering stable rental income from constant tourist flow.

Bur Dubai: Well-developed infrastructure and transport links, popular among families and expats working near the business hub.

Al Qusais: Primarily residential, with moderate prices, favors long-term rental investors.

Discovery Gardens: One of the greenest neighborhoods, offering leasehold apartments at attractive prices, close to metro and business zones like Dubai Internet City.

International City: Large residential complex with themed clusters (e.g., China, Greece, England), suited for budget-conscious investors seeking good rental returns.

Leasehold properties also exist in parts of Jumeirah, Dubai Silicon Oasis, Al Satwa, Mirdif, and Al Karama. Jumeirah offers villas and townhouses on 30-50 year leases near the beachfront. Dubai Silicon Oasis is a tech hub attracting IT professionals and suitable for investment. Al Satwa, near Sheikh Zayed Road and Downtown, is ideal for renters and investors seeking central location but budget options. Mirdif offers a green mix of apartments and townhouses suitable for families. Al Karama is a dense residential cluster with steady rental demand from residents on work visas.

Benefits of Buying Leasehold Property

Leasehold property purchase in Dubai is a sensible choice for those balancing affordable entry and access to one of the world’s most dynamic markets. Its affordability allows investors with limited budgets to buy homes in prime areas and earn rental income without large capital outlays.

Another important advantage is transparency and tenant protection. Lease agreements register with Dubai Land Department, ensuring legal safety. Lessees can use the property freely within contract terms: live, rent out, or transfer lease rights.

However, leasehold holds limitations. Ownership is time-bound, and major alterations require landlord consent. Annual service fees and maintenance obligations apply.

Overall, leasehold buying is smart for investors wanting to test Dubai’s market, obtain steady income, and avoid locking large sums in permanent property.

Who Can Buy Leasehold Property in Dubai

Leasehold purchase is available to UAE citizens and foreigners alike. Nationals of the Emirates and GCC may buy leasehold or freehold without restrictions; foreigners usually buy leasehold in non-freehold areas.

For non-residents, leasehold offers entry with lower expenses and no need for citizenship or long-term visas. Buyers sign leases granting use rights for a defined term (up to 99 years) with options to transfer or extend lease upon landowner consent.

This format suits expats, international firms, and private investors planning decades-long Dubai residence or work without committing large funds to freehold.

To find leasehold projects fitting your needs, visit the Mayak Real Estate investment page for personalized advice.

Lease Terms and Typical Costs

Leasehold ownership in Dubai follows clear legal norms defined in a lease agreement between landlord and lessee. This contract specifies term length, rights, duties, renewal conditions, and transfer process.

Standard lease terms run 30, 50, or 99 years. During, tenants may use, rent, or assign lease rights per agreement. Renewals are possible if both parties agree.

Subletting or lease transfer requires landlord approval and registration with Dubai Land Department, ensuring legality.

Besides purchase price, lessees pay mandatory fees:

Service charges for common area upkeep

Utilities per consumption (DEWA, gas, A/C)

Lease agreement registration fees at DLD

Renewal fees upon lease extension

Leasehold combines long-term usage convenience with predictable expenses and legal security at all ownership stages.

Investment Strategies for Leasehold

Investing in leasehold demands thoughtful strategy due to finite ownership and income variability. Despite temporal rights, leasehold properties deliver stable returns and diversify portfolios.

Popular tactics include:

Long-term rental: buying apartments/studios in leasehold zones to rent 10-20 years. Lower entry cost often yields higher ROI, especially in high-expat-demand areas like Discovery Gardens or International City.

Lease rights resale: capitalizing on property value rise by selling remaining lease to others, locking profit before term ends.

Short-term rental: acquiring properties for Airbnb-type leasing near tourist/business districts ensures quick returns.

Portfolio diversification: mixing leasehold and freehold mitigates risk and offers income plus capital growth balance.

Given Dubai’s stable rental market, leasehold remains appealing for investors seeking affordable entry, manageable risk, and steady income.

Conclusions

Leasehold property in Dubai offers accessible access to a fast-growing real estate market. Particularly attractive for foreign investors with limited budgets, it allows buying homes in prime locations without major freehold investment. The main feature is time-limited ownership (30-99 years) with land retained by landlord.

Leasehold purchase provides flexibility: leasing out, selling lease rights, and applying various investment strategies. High-demand leasehold districts include Deira, Bur Dubai, Al Qusais, Discovery Gardens, and International City. Key costs include service fees, utilities, registration, and renewal charges.

Careful lease agreement review and financial planning are essential. Mayak Real Estate’s experts assist in selecting districts, analyzing yield, and preparing legal documents.

Leasehold combines affordability, income potential, and easy market entry; expert support maximizes benefits of this property type in Dubai.

FAQ on Leasehold in Dubai

What is leasehold (leasehold) property? A right to use property for a fixed time (30-99 years), after which rights revert to landowner. Tenant may live, rent, or transfer within contract terms.

How does leasehold differ from freehold? Freehold means full property and land ownership with no time limits; leasehold means limited time, usually cheaper; choice depends on investor’s goals.

Who can buy leasehold property in Dubai? UAE nationals and foreigners. Foreigners mainly buy leasehold where freehold unavailable. Leasehold contracts ensure legal use and transfer options.

How long is the leasehold term? Usually 30, 50, or 99 years; renewals possible by agreement.

Can leasehold property be rented? Yes, most allow leasing; subject to contract conditions.

What costs come with leasehold? Annual service charges, utilities, registration fees, and renewal payments.

Can leasehold be resold? Yes, with landlord approval and DLD registration.

What are popular leasehold areas? Deira, Bur Dubai, Al Qusais, Discovery Gardens, International City, parts of Jumeirah and Al Satwa.