Dubai Real Estate Laws and Regulations

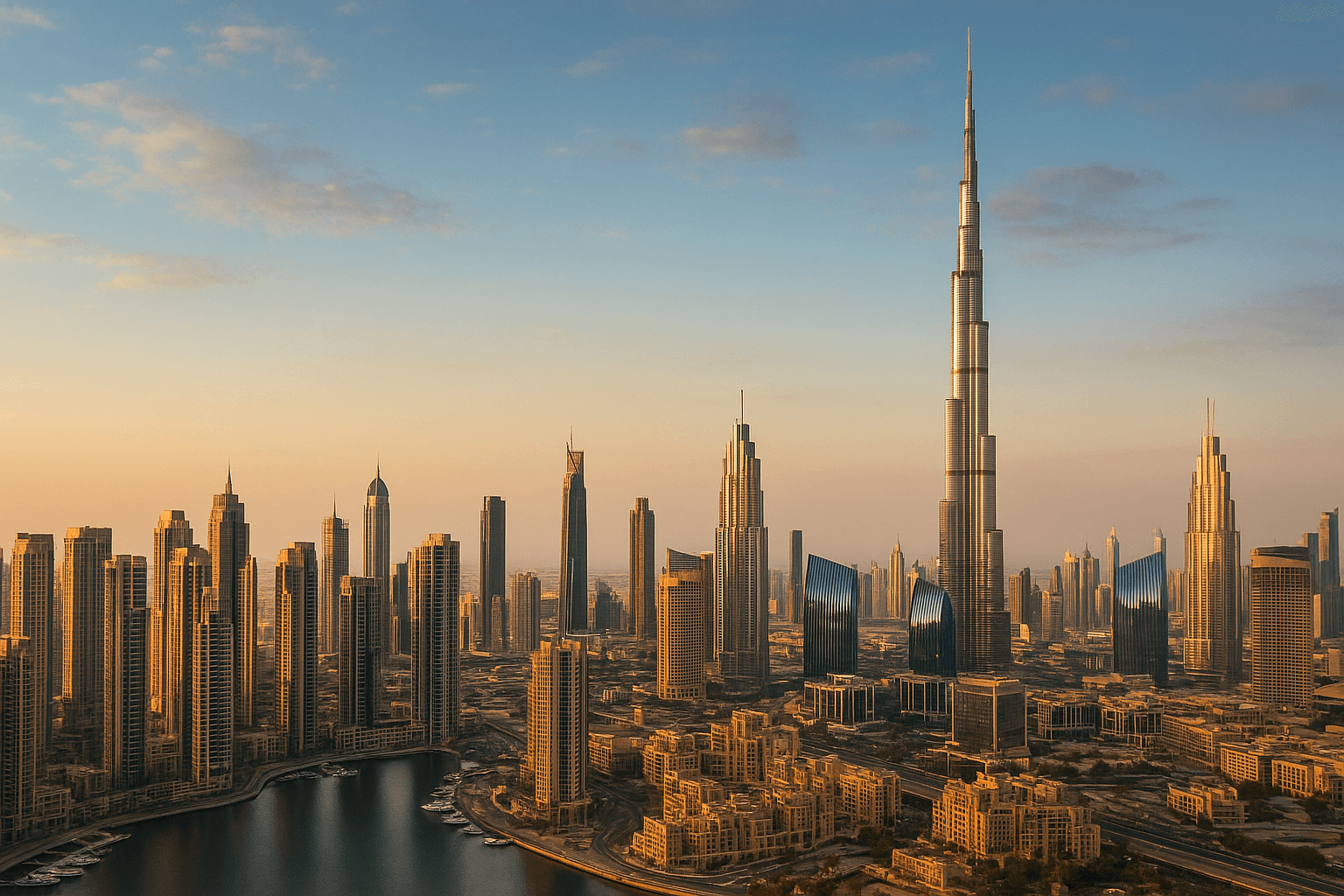

Dubai’s real estate market in 2025 remains one of the most dynamic and attractive investment destinations worldwide. The emirate has strengthened its reputation as a safe, transparent, and investor‑friendly environment, offering a wide range of properties — from premium beachfront apartments to modern villas and commercial spaces in emerging areas. However, successful buying or leasing in Dubai requires a clear understanding of local laws. Knowing the legal framework helps avoid risks, protect ownership, and complete transactions properly.

In 2025, Dubai introduced updated regulations aimed at increasing transparency, advancing digital transactions, and enhancing protection for foreign investors. These updates cover property registration, tenancy agreements, and investment‑linked residency options. Below is a detailed look at the laws shaping Dubai’s property market and their impact on owners and buyers.

Key Regulatory Authorities

Dubai’s real estate market is governed primarily by two government bodies: the Dubai Land Department (DLD) and the Real Estate Regulatory Authority (RERA).

DLD handles all property registrations, title deeds, and ownership transfers while maintaining transparency and investor trust through its centralized property database.

RERA, a division of DLD, oversees the entire real estate sector — developers, brokers, property management firms, and community governance. Its Ejari system is an official online platform for registering tenancy contracts, mandatory for landlords and tenants alike.

Supporting this ecosystem is Dubai REST, a digital app that allows investors to verify property details, market prices, agent licenses, and developer credentials — reinforcing trust and market transparency.

Rights of Foreign Buyers

Foreign investors play a vital role in Dubai’s property market. UAE law grants them broad ownership rights within designated freehold zones, allowing full property ownership, including the land beneath it. Owners may sell, lease, or bequeath their property without needing a UAE residence visa — a valid passport is sufficient.

Required documents for property purchase:

Valid passport

Signed sale and purchase agreement

Deposit receipt (typically 10% of the price)

Proof of DLD registration fee payment

Power of attorney (if applicable), notarised and legalised in the UAE

Foreign buyers can also purchase property through mortgages from banks such as Emirates NBD, Mashreq, and HSBC. Initial down payments usually range between 25–35%, with loan terms extending up to 25 years. Non‑residents must provide proof of stable income and a clear credit history, with minimum property values often starting from AED 500,000.

Buyers investing AED 2 million or more may qualify for the Golden Visa, granting 10‑year residency, family sponsorship, and enhanced mobility benefits. The visa is available even for mortgaged properties, provided at least 50% of the price is paid.

Transaction Costs and Fees

Property purchases in Dubai involve several fees, typically split between government charges and service costs:

DLD registration fee: 4% of purchase price + admin fee (AED 540–580)

Agency commission: approximately 2% of the sale price

Mortgage registration: 0.25% of loan amount + AED 250–290

Property valuation: AED 2,000–3,500 (depending on lender and property type)

Trustee Office service: AED 2,000–4,000

NOC from developer: AED 500–5,000 (varies by project)

Legal and notarisation fees: from AED 1,500 to AED 10,000+ depending on complexity

Miscellaneous fees: title deed issuance, bank transfers, and optional property insurance

Parties may negotiate who covers certain costs, such as agency commissions or NOC fees. Buyers are advised to obtain a full breakdown of expenses from their agent or legal advisor before signing any agreement.

Dubai Rental Laws

Tenant and landlord relations are governed by Law No. 26 of 2007 (as amended by Law No. 33 of 2008). All tenancy contracts must be written and registered in Ejari to be legally valid.

Standard tenancy duration: 1 year (renewable).

Contracts renew automatically unless terminated with 90‑day notice.

Rental increases follow the RERA Rent Index, ensuring rent rises stay within approved limits.

Early termination usually requires 60–90 days’ notice and payment of a penalty (1–2 months’ rent).

Disputes are handled by the Rental Dispute Settlement Centre (RDSC) under DLD, which offers a streamlined resolution process.

Additional Key Legal Frameworks

Escrow Law (Law No. 8 of 2007) — Developers must deposit buyers’ payments into escrow accounts tied to specific projects. Funds can only be used for construction, verified by DLD‑approved auditors.

Off‑Plan Sales Regulation (Law No. 13 of 2008) — Developers must register projects and sale agreements with RERA before advertising or selling, ensuring better buyer protection and transparency.

Joint Ownership Law (Law No. 6 of 2019) — Governs community associations, maintenance fees, and management companies. RERA oversees expenditures to prevent overcharging.

Taxation — The UAE has no property tax or capital gains tax. However, DLD fees, maintenance charges, and utility costs apply. Commercial properties may be subject to 5% VAT when used for business purposes.

Inheritance and Family Law — For non‑Muslims, inheritance defaults to Sharia law unless a will is registered with the DIFC Wills Service Centre, which allows for asset distribution under common law.

Consumer Protection Law — Developers and real estate agencies must provide accurate marketing information. Misleading advertising can result in fines or license suspension.

2025 Legal Updates

Recent amendments in 2025 focused on digitalisation, investor transparency, and freehold access expansion:

Stricter off‑plan funding rules with certified escrow audits.

Expanded freehold zones, now including Dubai South, Jumeirah Village, and Meydan.

Mandatory RERA‑verified listing registration for all property ads.

Full digital transformation of Ejari through Dubai REST, including resident information.

Reviewed maintenance and service fee structures to improve cost control.

These reforms strengthen Dubai’s global standing as one of the most secure and transparent property markets.

Conclusion

Dubai continues to lead the region as a model of real estate governance and innovation. Comprehensive laws, transparent digital systems, and investor‑friendly policies make it a premier hub for property investment. Understanding the legal framework — from Ejari and DLD procedures to ownership and taxation — is crucial for a smooth, compliant investment experience.

For personalized guidance and secure transactions, Mayak Real Estate offers end‑to‑end support — helping investors identify reliable developers, navigate contracts, and protect their interests throughout the process.