How to Check Property in Dubai Before Buying

Buying real estate in Dubai is one of the most attractive and promising ways to invest. To make the deal truly successful, it is important to complete every step correctly. High market transparency, strict regulation, and control by the Dubai Land Department do not fully eliminate all the risks that beginner investors often face.

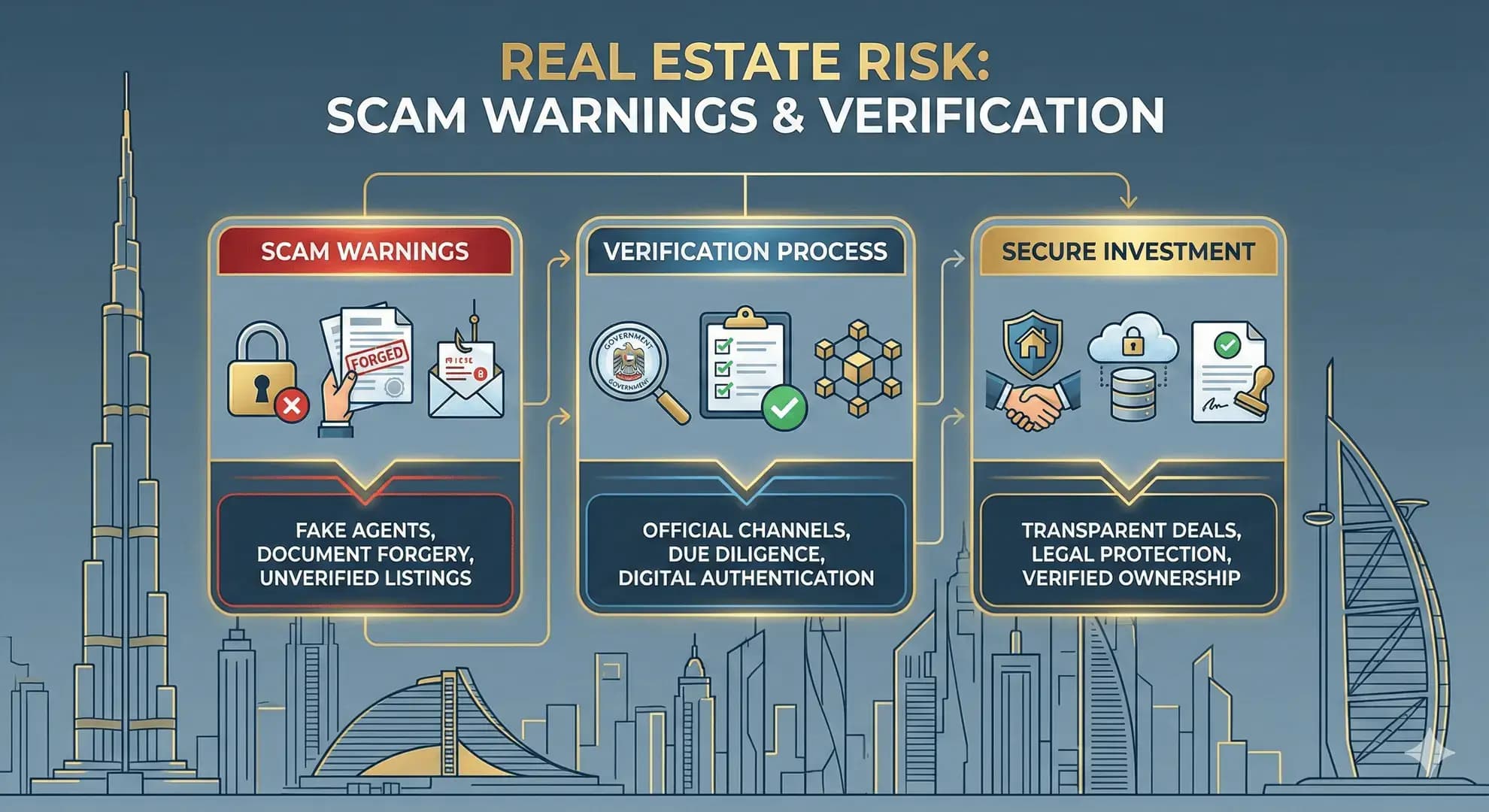

An unverified developer, lack of project registration, forged documents, incorrect payment structure — without proper due diligence, these issues can catch the investor off guard and lead to significant financial losses, construction delays, or even the impossibility of registering ownership. This is why it is crucial to check the developer, project, documents, construction status, and other important aspects before paying a deposit and signing the contract.

In this article, we will look in more detail at why you should always check a property and what exactly needs to be verified, how to correctly choose a broker for the deal, and how to avoid fraud when buying property in Dubai.

Why It Is Important to Check Property Before Buying

For foreign investors, buying property in Dubai often seems like a very safe and transparent process, although in practice risks still exist. One of the main reasons to carry out checks is a lack of knowledge about local legislation and market specifics, which can be exploited by unscrupulous intermediaries.

Fake companies may pose as developers or agencies without official registration with RERA. Those who are only planning to invest in Dubai real estate may not notice the red flags. However, there are typical signs of such companies, for example: offers of “unique conditions” or requests to pay the deposit directly, bypassing the escrow account.

There is another strong reason to check property in Dubai before buying — the risk of getting involved in a project that is not registered with the Land Department. If it is not in the register, this means there are no legal guarantees: construction may be frozen, postponed, or never started at all.

Beginner investors are also at higher risk of not noticing forged documents: fake sale and purchase agreements, non-genuine payment receipts, or a Title Deed that cannot be verified through DLD.

It is important to understand that even completely legal projects approved by RERA require regular monitoring during the construction stage. Both new and experienced investors need to ensure that the developer is following the construction schedule and that funds from the escrow account are being used strictly as intended. This significantly increases the chances of avoiding delays, unfinished projects, and other financial risks.

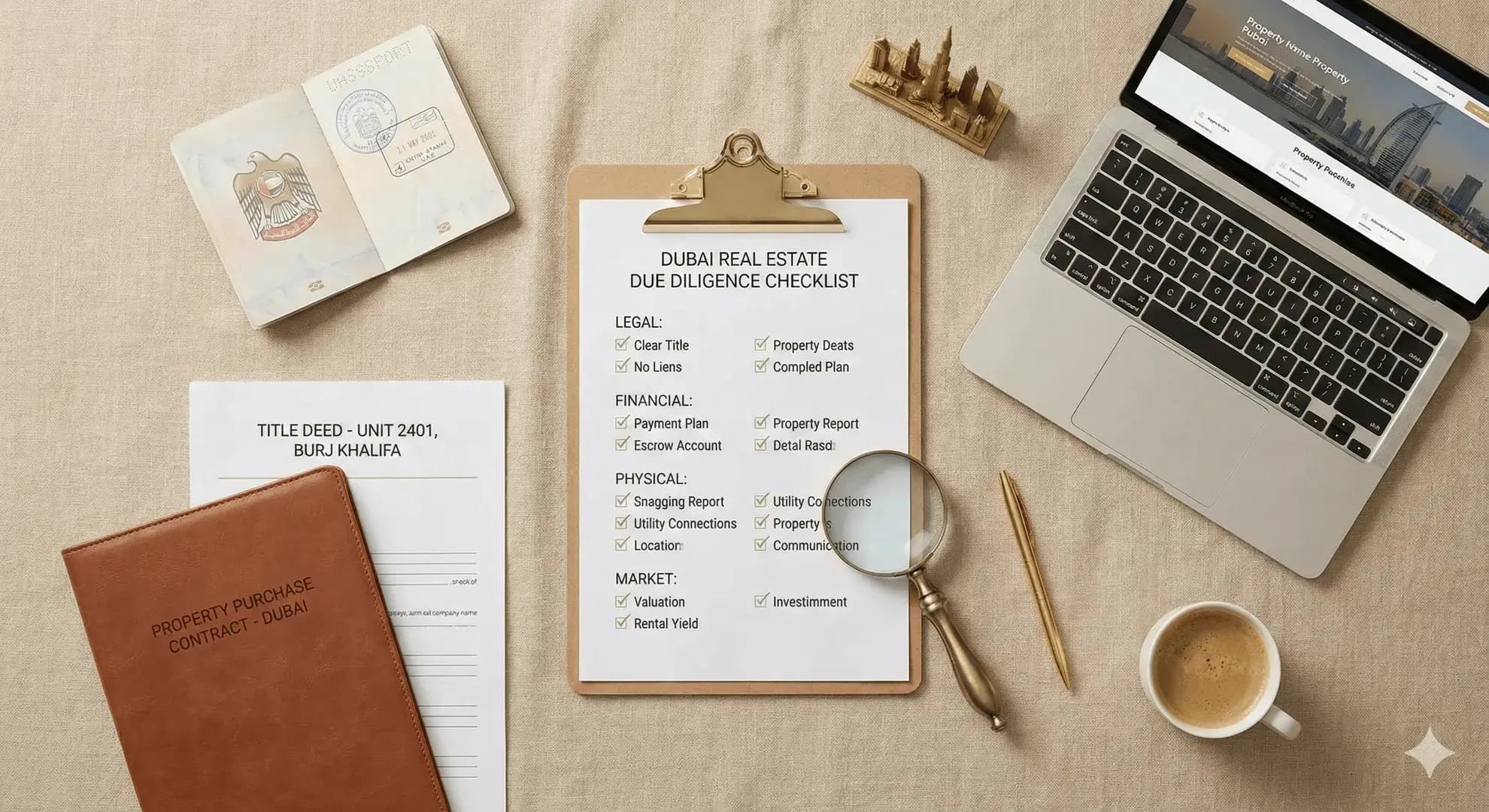

What Exactly Needs to Be Checked Before Buying

Before buying property in Dubai, it is important to have a detailed checklist that helps you verify the transparency of the project and the safety of the upcoming deal. The verification process does not take much time, but it allows you to avoid most of the risks foreign investors face.

Here is a brief list of key elements that must be checked before paying a deposit:

Developer and RERA licenses – legality of the company, reputation, completed projects

Project and construction status – registration with the Dubai Land Department, actual progress, work schedule, RERA reports

Documents and ownership – contracts, permits, Title Deed (for completed properties), authenticity of documents

Escrow account – existence of a separate account registered with RERA, correct account number

Broker and agency – RERA Broker ID, presence in the DLD database, representative’s authority

Next, we will review each of these points in more detail so you don’t miss anything important and can perform a truly thorough due diligence before purchasing a property.

Checking the Developer and RERA License

Checking the developer is one of the first and most important steps before buying off-plan property. You should not assume that choosing a well-known development company means you can skip this step. Reputation and official registration must be verified regardless of how popular the developer is.

Here is what should be checked:

Legal name and company registration number — with the Department of Economic Development (DED)

Registration and license with RERA — the Real Estate Regulatory Agency is a division of the Dubai Land Department

Portfolio of completed projects and their delivery timelines

Presence of lawsuits or claims

Buyer reviews

Financial stability — information about partners, bank guarantees, and work with escrow accounts

Searching the RERA database is a reliable way to check a developer in Dubai. To do this, follow these steps:

Clarify the exact legal name of the developer, especially if it is abbreviated in the offer or contract.

Open the official website of the Dubai Land Department / RERA.

In the Real Estate Regulatory Agency or Public Registers section, select the developer search function.

Enter the exact company name and click “Search”.

Check the results: presence of a RERA licens

e/registration number, status (active/inactive), list of projects, license issue date.

Compare the information found with the data in the commercial proposal and the contract.

If the data is missing or raises doubts, you can request scanned copies of licenses and an extract from the register directly from the developer and then repeat the verification. If the company still appears suspicious or there are no required records in the system, it is better to refuse to work with such a developer.

Checking the Project and Construction Status

After verifying the developer, the next important step is to make sure that the project itself is registered with RERA and DLD, and that its construction is progressing according to schedule. Even well-known developers can have delays in certain projects, so you should rely not on marketing materials, but on official data.

First, you should check the stage of completion of the project. To do this, open the project register of the Dubai Land Department or use the Dubai REST app. By project name or plot number, you can see in the system the percentage of completion, the date of the last update, and the status, such as “under construction”, “completed”, “on hold”, or “awaiting approvals”.

Next, you need to analyze the financial status of the project. RERA publishes reports indicating how the developer is spending funds from the escrow account and whether the actual progress corresponds to the declared schedule. If you check the project through RERA, you can see in the reports:

percentage of works funded

confirmation of payments to contractors

compliance with required technical standards

potential delay risks

If the project is not registered, has no escrow account, or the reports show signs of non-compliance, it is better to request clarifications from the developer or refrain from investing in such a property.

Mayak checks the project status free of charge before you pay a deposit.

Checking Documents and Ownership Rights

Before buying an apartment or villa in Dubai, you must ensure the seller has the legal right to dispose of the property being sold. For this, you need to check the property’s documents.

Which documents must be verified:

Title Deed – the official ownership certificate issued by the Dubai Land Department. It includes all property parameters: unit or plot number, type of ownership (freehold or leasehold), owner details, and legal status.

Sale and Purchase Agreement (SPA) – contains the terms of the deal, describes the property, price, payment plan, timelines, and obligations of the parties. Without a correct SPA, registration of ownership is impossible.

Initial Sale and Purchase Agreement – a digital certificate issued by DLD when the property is purchased at the construction stage. This interim document confirms that the project is registered with the developer and the contract is approved.

No Objection Certificate (NOC) – a document issued by the developer in case of resale. The certificate confirms there are no outstanding payments, restrictions, or utility debts, which is crucial for a clean transaction.

When checking the documents, it is also important to make sure that the Title Deed is genuine, which can be done through the Dubai Land Department. The most convenient way is to use the Dubai REST app. You need to download it, go to the property verification section, enter the Title Deed number and other required details. The system will provide confirmation, showing the owner’s name, property type and status, and whether there are encumbrances, mortgages, or restrictions.

Another way to verify the Title Deed is via the official DLD website: the e-services section has a similar function. You enter the document number and data from the Title Deed to see all necessary information.

For major or corporate transactions, the parties may personally visit the DLD office or an authorized Trustee center. There, they check the original document, its registration, and confirm that the ownership is indeed recorded.

Whichever method is used, the Title Deed number must match the one stated in the contract. The ownership type (freehold or leasehold), address, and unit number must also be identical. You should also make sure that there are no encumbrances, pledges, or other restrictions (mortgage, arrest, etc.).

Escrow Account and Payment Security

The escrow account is an important tool that makes Dubai’s real estate market one of the safest for buyers. It is a special bank account where all investors’ payments are deposited when buying property at the construction stage. Funds do not go directly to the developer: the bank holds them until the developer confirms completion of the next construction milestone. Only after verifying the progress does RERA allow the bank to transfer part of the funds. This protects the investor from unfinished construction and misuse of their money.

Under Dubai law, each developer is required to open a separate escrow account for each project. This account must be registered with RERA, and information about it must be available in official registers. If a developer suggests transferring money to a regular bank account or paying in cash, it is better to refuse participation in such a project.

Here is how to check the escrow account number:

Take the details indicated in the contract or invoice: escrow account number, bank name, project name.

Open the Dubai REST app or the official DLD website.

In the Escrow Services or Project Information section, enter the project or developer number.

Make sure the account number matches the one in the register and the status is active.

Additionally, you can call the bank indicated in the documents and request confirmation that the account really belongs to the project.

If the data does not match, it is best not to pay any deposit until the situation is completely clarified.

Checking the Agent and Real Estate Agency

In Dubai’s real estate sector, only licensed agents registered with RERA are allowed to work. Every broker must have a RERA Broker ID — a personal identification number confirming their qualifications, completion of mandatory courses, and registration in the official database. The absence of this number or refusal to provide it is a clear sign that you should find another agent to handle your purchase.

Checking an agent only takes a few minutes. The most reliable and convenient way is to use the official Land Department website or the Dubai REST app. In the Real Estate Brokers or RERA Broker Inquiry section, you should enter the broker’s name, Broker ID, or the agency name. The system will display full information: whether the broker is active, which company they belong to, whether that company has a license, whether there were violations, and the validity period of registration.

It is also important to check the agency the broker works for. Every company must have a valid RERA registration number. If an agent suggests signing documents not on behalf of the registered company or accepting payments to third-party accounts, this significantly increases risks.

How to Avoid Fraud When Buying Property

Although Dubai’s real estate market is highly regulated, fraud does still occur. Most often, this happens with investors who lack experience, rely on unverified information, and act without professional support. Knowing the most common schemes can help protect your money and avoid issues when investing in real estate.

Here are some of the most frequent fraud schemes:

Selling properties on behalf of unregistered developers. The buyer is offered a “profitable project” that is not in the RERA register or that has no escrow account. The investor transfers money directly to the company and then loses control over the funds.

Forged documents — Title Deed, SPA, NOC. Dishonest brokers or sellers use fake documents, knowing that foreign buyers rarely verify authenticity through DLD.

Selling the same apartment to multiple buyers. This occurs when the Title Deed is not properly checked and the buyer fails to see whether a current owner and past transactions are already registered.

Non-existent “discounts” on behalf of the developer. Scammers use the name of a famous developer, offering discounts and conditions that do not exist on official websites.

To avoid such risks, you should follow these important recommendations:

Verify the developer and project only through official DLD and RERA services.

Work only with agents who have a valid RERA Broker ID.

Ensure that all payments go through an escrow account registered with RERA.

Check the authenticity of the Title Deed, NOC, and SPA via Dubai REST.

Review the history of the property: whether there are mortgages, encumbrances, or court-related restrictions.

Do not transfer money to personal accounts and do not sign documents outside a licensed agency.

Put all agreements in writing, as verbal promises have no legal force.

Buying property in Dubai can be safe and predictable if you carefully verify every stage of the transaction and use only official sources for checks.

FAQ

Do I need to check the developer if they are well-known and have many projects?

Yes, you do. Even large developers can have project delays or financing issues. Checking via RERA and DLD is a mandatory step for any investor.

How can I find out if a project is registered with RERA?

This can be done through Dubai REST or the DLD website. Simply enter the project name or plot number — the system will show registration status, construction progress, and whether an escrow account exists.

Can I verify the authenticity of the Title Deed online?

Yes. The Dubai REST app has a Title Deed Verification feature. Enter the document number — the system will confirm the owner, type of ownership, and show whether there are encumbrances.

What should I do if an agent does not provide a RERA Broker ID?

You should refuse to work with this agent. Lack of an ID means the broker is not licensed and has no right to conduct transactions.

Is it safe to buy property at the construction stage (off-plan)?

Yes, if the project is registered, has an escrow account, and the construction progress matches RERA reports. In this case, the buyer is protected both legally and financially.

Can I transfer the deposit directly to the developer?

No. All payments for off-plan property must go only through an escrow account so that the funds are protected until the project is completed.

How can I check that the property has no debts or restrictions?

This information appears when checking the Title Deed. If there is a mortgage, arrests, or other encumbrances, the system will definitely show it.